As April 2023 sees Australia’s inflation rates unexpectedly spike, key economic sectors and consumer prices are feeling the impact.

Rising Inflation in Australia Surpasses Market Predictions

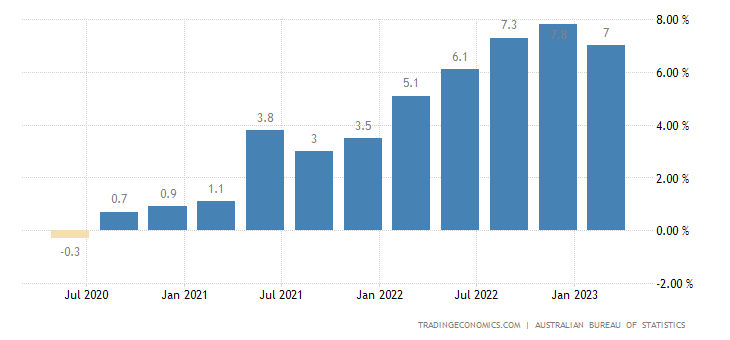

April 2023 saw an unexpected surge in Australian inflation. According to new data released by the Australian Bureau of Statistics (ABS), the annual inflation rate escalated to 6.8%, an increase from 6.3% in the previous month. Although this rate is a step down from the 8.4% peak in December 2022, it still surpasses the 6.3% annual increase reported in March 2023.

May witnessed a significant slowdown in Australia’s consumer inflation, reaching its lowest point in 13 months. This slowdown, primarily triggered by a considerable reduction in fuel prices, also led to a cooling effect on core inflation, indicating a potential halt in the increase of interest rates in July.

Wednesday’s data from the Australian Bureau of Statistics revealed a 5.6% increase in its monthly consumer price index (CPI) in the year up to May. This marks the least significant rise since April of the previous year.

This figure represented a decline from 6.8% the prior month and significantly fell short of market predictions, which anticipated a 6.1% increase.

On a monthly comparison, May’s CPI declined by 0.4%. The annual core trimmed mean measure of CPI, a key indicator, saw an increase of 6.1%, recording a seven-month low, down from April’s 6.7%.

Fuel Prices Primary Contributor to Inflation

Michelle Marquardt, ABS Head of Price Statistics, attributed the persistent inflation to the rising fuel prices. She noted, “Automotive fuel has significantly impacted the annual movement in April.” The effects of the fuel excise tax, which was halved in April 2022 and fully restored by October 2022, continue to influence the annual inflation rate for April 2023.

Understanding the Trends Through CPI

The Consumer Price Index (CPI), which measures changes in prices across a variety of goods and services, provides further insight into this trend.

Annual Inflation Slows Down, Quarterly Consumer Prices Rise

Despite reaching a 30-year high of 7.8% in the previous quarter, the annual inflation rate in Australia reduced to 7.0% in Q1 of 2023, a figure slightly above the market forecast of 6.9%. This is the lowest figure since Q2 of 2022, with food prices marking the smallest rise in the past three quarters. However, consumer prices saw a quarterly increase of 1.4%, driven by increasing costs of medical services, tertiary education, gas, household fuels, and domestic holiday travel.

Sector-Specific Inflation Trends

Several sectors also recorded slowed cost growth, including transport (4.3% vs 8.0%), housing (9.8% vs 10.7%), furnishings (6.7% vs 8.4%), and recreation (8.6% vs 9.0%). Stable inflation was reported for alcohol & tobacco (at 4.4%), while health (5.3% vs 3.8%) and insurance & financial services (6.5% vs 5.0%) experienced accelerated price growth.

The RBA Trimmed Mean CPI Overview

Finally, the RBA Trimmed Mean CPI recorded a 6.6% year-on-year increase, falling slightly short of the 6.7% consensus. Although this is a decrease from the record 6.9% increase in Q4, it still falls outside the central bank’s target of 2-3%. On a quarter-to-quarter basis, the index saw a 1.2% increase.